About that Gap

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 37.

In case you missed it, the weekend note came out on Sunday morning EST. In it, the🐿️ revisited our credit hedge and a couple of other ‘R-word’ trades. Do check it out. A fuller ‘start the week’ note this week. Making some changes in BUSHY™.

Making sense of Junk

Enough ink has already been spilled mocking the traditional metrics and indicators used by economists to forecast a recession. The 🐿️ is not going to join the mob.

About that Gap

BUSHY™ had a solid week - pleasing, but no particular cause for celebration - pretty much everything went up last week - except for Treasury yields and our Nasdaq put spread!

There are a few important things to address in this week’s portfolio update (including a couple planned changes for the coming week). However, as promised in Sunday’s note, I first want to resurface a concept I first raised back in July in Mind ‘The Gap’.

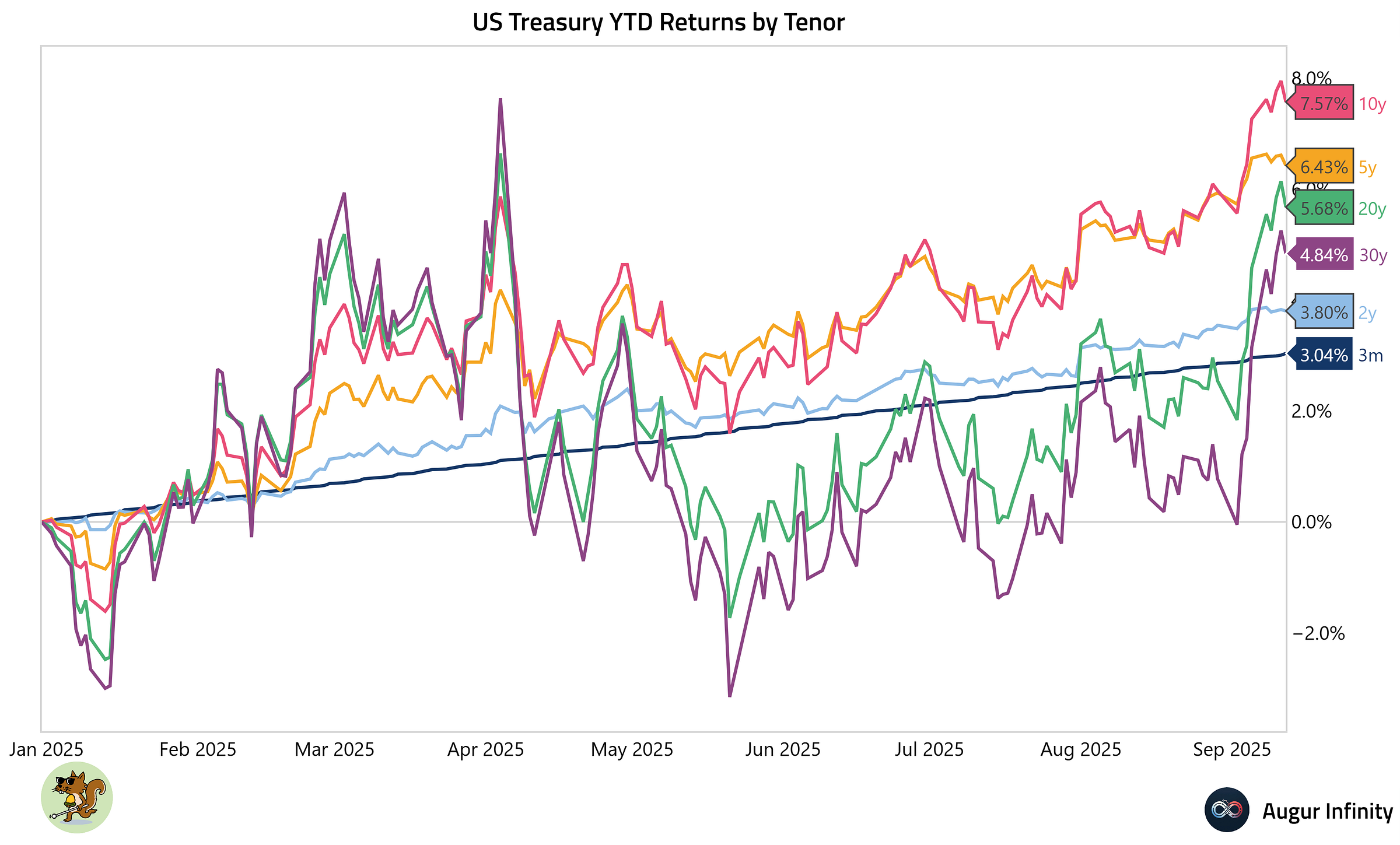

Last week saw a massive compression in bond yields across the US yield curve. Market participants have clearly decided that rate cuts are coming a-plenty. Long bond total returns have gone from flat to +4.84% since Labor Day.

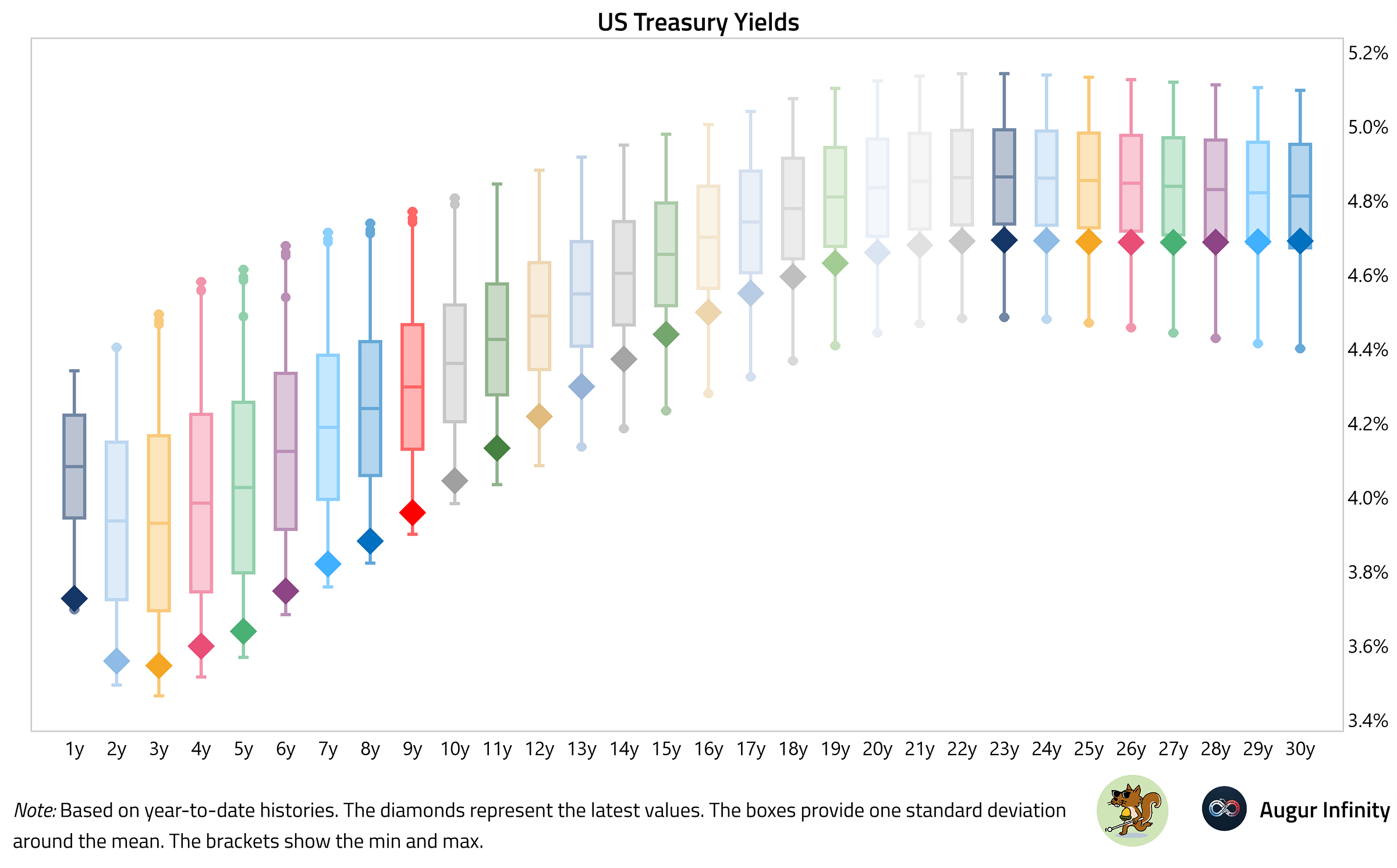

If you then look at my favorite yield curve visualization (below - crafted by my pals at Augur Infinity), I find myself feeling that the best returns have already been seen in Treasury land.

Unfortunately, the 🐿️ has only been a spectator when it comes to this summer’s bond rally. We sold our 2-year Note position a while back and currently only have some modest positions in December 26 & 27 SOFR futures which I am inclined to let go of soon.

In terms of longer duration exposure, BUSHY™ is in fact has a ‘short’ position in the long bond via the PFIX ETF from Simplify.