A Trillion to Tashkent

Scott Osheroff is true emerging market frontiersman. On Tuesday, he and I sat down to discuss the investment opportunity in Uzbekistan. This is a macro story that ticks multiple boxes for the 🐿️.

I had been doing quite a bit of homework on this topic and I wanted to time our conversation for after the recent Templeton / UzNIF investor day in Tashkent. This weekend’s note will be my deep dive on the opportunity.

In the meantime, please enjoy our discussion as an introduction to the theme.

Following Yurta

Scott is the CIO of the AFC Uzbekistan Fund (link) and CEO of Yurta Capital (link). You can follow him on Twitter and he provides regular market commentary on the Yurta Telegram channel.

Podcast Overview

00:00 — Introductions and Background

We cover Scott’s early career in Southeast Asia, involvement with Asia Frontier Capital, and start in Myanmar. In 2018, Scott toured Kazakhstan, Kyrgyzstan, and Uzbekistan, noting Uzbekistan’s impressive growth and infrastructure. He convinced AFC to launch a fund focused on Uzbekistan to capture this unique opportunity.

03:00 — Central Asia overview and geopolitical context

Scott explains Central Asia’s geopolitical importance, highlighting Uzbekistan as the “belt buckle” of China’s ‘Belt and Road’ Initiative and the competing influence from China, Russia, Turkey, Middle East, Europe, and the US.

06:00 — The Uzbekistan macro story

Scott covers Uzbekistan’s hawkish central bank, inflation reduction from ~20% to ~8.5%, economic growth of ~6%, and a stronger currency fueled by gold production and remittances. The regulatory environment is open for foreigners to invest, with high yields on government bills, term deposits, and corporate bonds (up to 30%). Investor capital controls exist but are easily manageable for foreigners.

12:40 — Uzbekistan National Investment Fund (UzNIF).

Scott explains UzNIF, the fund holding shares in state-owned Uzbek enterprises that is expected to be dual-listed in London and Tashkent early in 2026. Managed by Franklin Templeton, the UzNIF portfolio includes banks, utilities, and transportation assets. The fund will be listed as part of a broader privatization push.

18:00 — Investor interest and governance reforms

Scott talks about high level of global investor interest at the recent UzNIF investor day, highlighting Franklin Templeton’s role in improving SOE governance, including in board and management appointments and influence on robust capital allocation discipline.

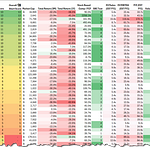

23:00 — Public market valuation and banking sector

Uzbek listed banks and industrials trade at low valuations. Banks currently trade at 1-2x book, with low single digit PEs of 3-4x - with very rapid earnings and book value growth (30-40%+ annually). Banking is transitioning to digital but remains traditional, primarily lending in local currency. Rising interest income spreads make the sector attractive.

28:00 — Metals production and fiscal reserves

Scott highlights the Navoi gold mine (the world’s 4th largest) and a large copper mine expansion at Almalyk as key drivers of the Uzbek resource story. The country is fiscally sound, with a well-managed reserve policy. Uzbekistan holds $50-55 billion in FX reserves, with a large share in gold.

30:30 — What can go wrong?

Scott sees no major political risk despite uncertainties about presidential succession. The economy is moving away from manufacturing, which is declining due to subsidy removal, toward services, logistics, and tourism. Remittances from 5 million overseas Uzbeks form a large part of GDP (around $18 billion). Growth may slow in a downturn but remains robust.

34:30 — Closing remarks and more about Yurta!

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.