A Fitting Tribute

“Over a long enough time horizon, everyone agrees with IBWOC.” The Blind Squirrel's Monday Morning Notes. Year 3; Week 15.

Last week’s chaotic week in markets was tragically missed by a Wall Street legend who was 100% born to trade it.

A Fitting Tribute

Last week, Wall Street lost a legend. I never met Morris Sachs (‘MB’) in person. I first came across him when ‘Motown’ was a regular visitor to the comments section of Kevin Muir’s research notes from where he was finally persuaded to make a ‘blockbuster’ debut appearance on The Market Huddle in the depths of the Covid lockdowns of May 2020.

MB’s ‘must listen’ appearances on ‘The Huddle’ were the springboard for the launch of his own ‘Inside Baseball with Old Chestnut’ podcast with his friend, cycling buddy and market padawan Liam Allen. The 🐿️ never missed a single one of the show’s 186 episodes (though I do confess to have skipped thePhish intro every week).

When someone with MB’s deep experience in markets is prepared to share an hour of his wisdom (almost) every weekend, only a fool would not take advantage. So much learning from what was said (and often from what was not said).

I was truly ‘star struck’ when I learned that MB was a regular reader of my own letter and the first time the 🐿️ got a ‘shout out’ on the podcast was a genuine ‘mic drop’ moment. My yelp of excitement at that moment turned every head in the dog park! I am honored and truly grateful that he became a huge supporter of my work. We became regular ‘pen pals’ over the next 3 years.

His innate kindness, razor-sharp wit and impish sense of humor sang out of his emails. I often found myself wishing I had had a mentor of MB’s caliber and character helping me grapple with the greasy pole of high finance. Am sure that countless other listeners feel the same way.

I used to wonder why, on occasion during an episode of the pod, Liam appeared to sound almost hyper protective of a man who, schooled by the hand-to-hand combat of the futures pits of Chicago, most certainly could fight his own corner. Sometimes a couple of weeks would pass before I got a response to a note or question. I now understand why. He was fighting for his life and yet still generously making the time to educate and to entertain us all.

He will be truly missed, and I again send my deepest condolences to Liam, Sheryl, his daughters and the broader Sachs clan. How fitting it was that I learned of his passing during that ‘deep red’ futures open last Sunday night. These are the types of markets that were made for trading legends like MB. I am convinced that he would have been in his ‘alpha long bond trader’ element last week.

The rest of us trading mortals are left behind to make sense of the bond markets without his invaluable guidance. And it was quite a week to have to start doing that alone! Rest in peace, Old Chestnut.

Taking Stock of Last Week

One of the biggest challenges of writing this letter each week is trying to pick a theme or topic which is unlikely to be covered by other market commentators. Some weeks - like this one - the task is impossible. As such, we have to start with rates and the US dollar.

This was the week in which the traditional ‘safe haven’ roles of US Treasuries and US dollar cash were called into question. Barring Wednesday’s ‘Gift to the Grift’ (more on that later), the second week of risk asset carnage following ‘Liberation Day’ saw a complete breakdown of traditional cross-asset relationships.

A world of market ‘fear’ consistent with elevated equity volatility (VIX spending all week in 30 to 60 range) should have seen market participants rushing into bonds. Nope!

Instead, we saw bond volatility (MOVE) spike and 10 and 30-year Treasury yields putting in one of their largest weekly increases in decades.

Even 2-Year note, the pole star of MB’s daily analysis of financial markets was not spared. 2-year notes have been yielding less than the Fed Funds rate since the beginning of the year but were sold aggressively over the week.

Even this move in 2-year yields was not enough to disguise the most violent weekly steepening of the US Treasury yield curve since last year’s presidential election.

What Julian Brigden memorably styles as a ‘dollar napalm run’, when all risk assets are sold in order to raise US dollar cash, did not happen either. The dollar accelerated its year-to-date decline to levels not seen since April of 2022.

Yield differentials between the US 10-year and German Bunds narrowed by its largest weekly delta since the early 1990s. Stories of blow-ups of Treasury relative value trades and imploding Japanese hedge funds cloud the real story.

For the record, the 🐿️ does not subscribe to the ‘predatory Treasury dumping’ by China / Japan / The Medicis (I kid you not - I really came across that one down one particular rabbit hole!) narratives being espoused by certain fringe quarters of the commentariat.

Foreign capital does not like the look of the Trump administration’s trade war. It looks to be taking away its ball and going home.

A Gift to the Grift

With volatility markets in the ‘red zone’ and with sentiment and positioning at extremes, the ingredients of an explosive bear market rally for equities were firmly in place. All that was required was for the fuse to be lit. The spark took the form of the announcement of the 90-day pause on reciprocal tariffs.

Whether the announcement came because of pressure from those “yippy” bond markets or as a result of some unsubtle lobbying by Jamie Dimon via Maria Bartiromo on Fox Business, the equity market’s reaction was as violent as you would expect.

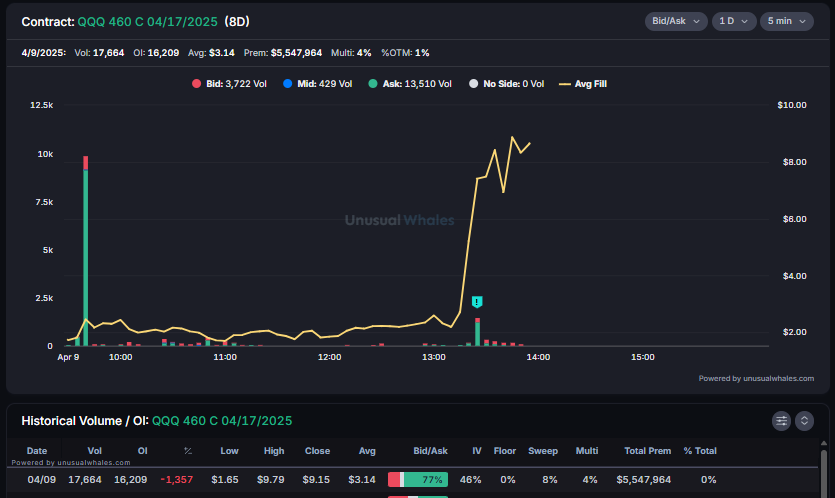

Some ‘unusual’ trades in QQQ 0.00%↑ call options that morning would appear to imply that some fortunate insiders were tipped off. Click to the evidence via the image below and judge for yourself. It would certainly strike me as ‘on brand’ for an administration that brought you the $TrumpCoin and $MelaniaCoin rug pulls. Just sayin’.

And a ‘face ripper’ of a rally we most certainly got on Wednesday! Those ‘teenie’ calls paid out in spades. The Nasdaq’s +12% jump was the largest since 2001; the +9.5% S&P 500 move was the biggest since the depths of the financial crisis in 2008.

We can possibly expect another pop in US equities on Monday off the back of the growing list of sanction safe harbors (smartphones and semiconductors etc.) that have emerged over the weekend. I expect many (especially foreign) investors to be very grateful for the exit liquidity on offer in Apple on Monday.

However, now that the dust has settled on last week, let us return to this rodent’s favorite ‘chart of truth’ when it comes to the international equity rotation - the ratio of the S&P 500 to the MSCI EAFE (developed markets ex-US index). International equities benefited almost by the same amount as US equities from the tariff pause, ending the week up only 0.19% less than the S&P and still 13.02% ahead for the year.

I do believe that it is now ‘game on’ with respect to international investors starting to address their (now almost 2 decade) overweight allocation to US risk assets. Institutional money flows slower than tourist dollars, but Apollo’s Torsten Slok reminds us of the absolute numbers involved across various asset classes:

Last week’s move across the rates complex and the US dollar makes complete sense to me. I believe that whichever way the trade war is resolved from here, we will be looking at a world of less global trade that is driven by the engine room of the US consumer and hence less demand for US dollars.

This change comes just as the rest of world switches on the fiscal taps to replace / supplement their defense / security umbrellas and stimulate (desperately needed) nominal growth. It is no longer just an issue of a shift in preference away from richly valued US financial assets.

There is strong demand for that capital at home. The fiscal dominance that has been responsible for so much of the outperformance of US financial assets for the past few years is now packing its bags for a global tour.

Last week’s trade war pivot / blink / chapter [delete as applicable] has probably managed to stave off a global depression. Those bellicose penguins of Heard Island are certainly relieved! US consumers have also been spared from $3,000 iPhones (funny how that loophole was not announced in The Rose Garden).

The painful reality of this trade war was that it was a political choice. Sadly, now irreversible. The trade war genie is now out of the bottle and is in absolutely no hurry to return to its glass home (even if the Trump administration wanted it to - and I am not yet anywhere close to sensing regret on that front). As such, we are far from being out of the woods economically.

Measures of US economic policy uncertainty remain at ‘higher than Covid’ levels. I have spent too many hours this past month reading about trade war game theory (TLDR - nobody wins).

In Section 2 below, the 🐿️ revisits recession odds and a trade of which MB would probably not have approved. It may be ‘lead metal’ related - IYKYK. I feel very sad that I cannot now expect a (charmingly worded) reprimand email from him.

Join hundreds of smart investors, market watchers and upstanding citizens by becoming a paid subscriber to Blind Squirrel Macro and receiving the other 70% of 🐿️ content, members’ Discord access (The Drey) and even ‘limited edition’ merch!).